DEVELOPING CARBON MARKETS

Carbon trading

We are focused on building global supply chains to support the growth of voluntary and regulated carbon markets.

We offer a range of products and solutions to help organisations reach their low-carbon objectives and our investments are also making a positive impact on local communities and the environment.

BESPOKE SOLUTIONS

We understand that every organisation has unique requirements

We provide companies with a comprehensive range of carbon products tailored to their climate strategies and sustainability goals.

CARBON MARKETS

Our work across carbon markets

Voluntary and regulated carbon credit markets are essential to achieving global climate goals. Trafigura is supporting the development of these markets and is also investing in nature-based removals projects to produce high quality carbon credits.

Project development

Voluntary carbon markets

Compliance carbon markets

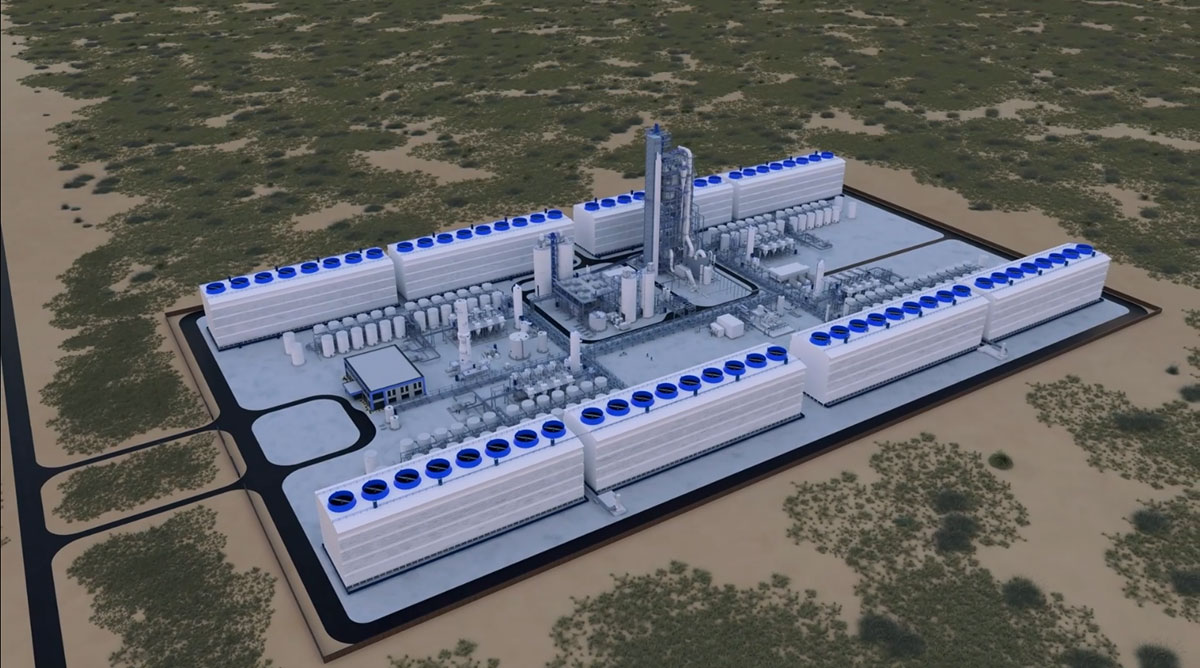

CARBON REMOVALS PROJECT DEVELOPMENT

Our approach to investing in carbon projects

As more companies target ambitious emissions reductions and net zero targets or are subject to climate regulations, demand for high quality carbon credits is increasing, particularly from projects that sustainably remove greenhouse gas emissions. We are investing in carbon removal projects that benefit from scale, and strong governance.

You may also be interested in

Explore our publications and get

the latest news and insights.